Nov. 29, 2010 at 4:16 p.m.

Filed under:

Credit Cards,

Entertainment

By Associated Press

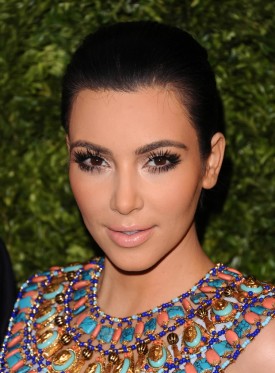

(Andy Kropa/Getty Images)

The Kardashian sisters are seeking to cut ties with a venture that sold prepaid debit cards under their name after coming under attack for the card’s high fees.

The card, which launched last month, was aimed at young adults, the same group that watches the sisters’ hit cable TV show “Keeping Up With the Kardashians.”

An attorney for the sisters sent a letter Monday to parties affiliated with the card demanding they stop using the names and images of the three sisters. Get the full story »

Nov. 29, 2010 at 1:19 p.m.

Filed under:

Credit Cards

By Becky Yerak

Swiping your plastic is becoming a thing of the past.

Riverwoods-based credit card company Discover said it began issuing Discover Zip contactless credit cards and stickers on Nov. 15.

The way it works, consumers touch a payment device, which is in the form of either a plastic card or a sticker that can be applied to a mobile phone or any personal item, to a Zip-enabled contactless reader to make a payment. Currently, more than 100,000 U.S. locations, including restaurants, gas stations and convenience stores, offer contactless readers that accept Zip transactions at cash registers. Get the full story »

Nov. 29, 2010 at 8:25 a.m.

Filed under:

Credit Cards

By Margaret O'Brien

(Nhat V. Meyer/San Jose Mercury News/MCT)

The nation’s credit-card delinquency rate fell in the third quarter, to 0.83 percent, according to a report by Chicago-based credit reporting firm TransUnion. This represents a 9.8 percent decrease from the previous quarter in terms of borrowers whose accounts are 90 days or more delinquent, and a 24.6 percent decline from the year-ago quarter.

TransUnion also estimates that 8 million consumers stopped actively using bank-issued credit cards in the past year.

The trends stem in part from some seriously delinquent debt being classified as uncollectable, and in part by more conservative spending in lower risk segments of the population, the company said. Get the full story »

Nov. 26, 2010 at 12:40 p.m.

Filed under:

Credit Cards

By Reuters

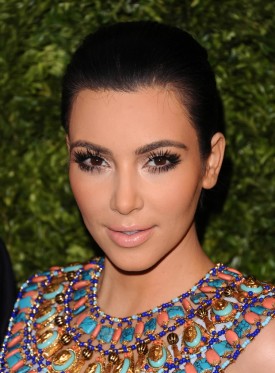

Kim Kardashian. (AP Photo/Peter Kramer)

Keeping up with the Kardashians can be costly for young adults enticed by a debit card tied to the popular reality TV series, Connecticut’s attorney general said.

Richard Blumenthal, the attorney general and senator-elect, issued a “Black Friday” warning to parents about the ”Kardashian Kard” and other prepaid debit cards that he said burden cardholders with “outrageous” fees.

In a letter to University National Bank, which issues the Kardashian Prepaid MasterCard, Blumenthal complained about card fees of $59.95 for six months or $99.95 for 12 months, plus $7.95 a month thereafter, as well as fees for ATM withdrawals, cancellations and talking with a live phone operator. Get the full story »

Nov. 24, 2010 at 6:14 a.m.

Filed under:

Credit Cards

By Associated Press

Debt isn’t stressing people as much as it had been, but consumers remain gun-shy about embarking on a big holiday spending spree.

An Associated Press-GfK Poll also suggests Americans are more disciplined about using their credit cards. Deep into a stubbornly harsh economic downturn, more people than last year say they pay off their balances right away, and fewer say they make credit card purchases if they lack enough money at the time. Get the full story »

Nov. 19, 2010 at 6:26 a.m.

Filed under:

Banking,

Credit Cards,

Crime,

Criminal charges

By CNN

A Malaysian man was charged on Thursday for hacking into the computer network of a U.S. Federal Reserve bank and for stealing more than 400,000 stolen credit card and debit card numbers, according to federal authorities.

Lin Mun Poo, 32, is suspected of accessing financial records at a Federal Reserve Bank in Cleveland, Ohio, by “exploiting a vulnerability he found within their secure system,“ according to a statement by the U.S. Attorney’s Office of the Eastern District of New York. At least 10 Federal Reserve Bank computers were affected by the breach, resulting in thousands of dollars in damage, the statement said. Get the full story »

Nov. 15, 2010 at 4:39 p.m.

Filed under:

Credit Cards

By Associated Press

Write-offs of uncollected Discover Card balances and late payments both fell in October to their lowest levels of the year. Get the full story »

Nov. 15, 2010 at 3:29 p.m.

Filed under:

Credit Cards,

Technology,

Telecommunications

By Reuters

Mobile phone companies Verizon Wireless, AT&T Inc and T-Mobile USA are poised to announce plans for a venture offering mobile payments services, people familiar with the matter told Reuters on Monday.

Discover Financial Services and Barclays will also announce they are participating in the joint venture, which will allow consumers to pay for purchases with their cellphones, the people said. Get the full story »

Nov. 15, 2010 at 5:42 a.m.

Filed under:

Credit Cards,

Retail

By Associated Press

They can tempt customers with discounts and short-term low interest rates, but a New York congressman is warning people to stay away from store credit cards as the holiday shopping season gets underway.

U.S. Rep. Anthony Weiner released a study Sunday that shows some store credit cards have interest rates that are substantially higher than regular credit cards. Get the full story »

By Mary Ellen Podmolik

The Illinois Attorney General’s office filed a lawsuit against Chicago-based Illinois Loan Modification LLC, Omega Business Center, its managers and related businesses, alleging that they preyed on residents of the Chicago-area’s Polish community by falsely promising mortgage and credit card relief.

The suit, filed Tuesday in Cook County Circuit Court, charged that the companies and their affiliates charged upfront fees to consumers but the promised services were never provided and customers who canceled their contracts were not issued refunds. Get the full story »

Nov. 8, 2010 at 5:42 a.m.

Filed under:

Banking,

Credit Cards

By Dow Jones Newswires-Wall Street Journal

Less than a year after the passage of new laws limiting banks’ ability to impose certain fees on credit and debit cards, Bank of America Corp., Discover Financial Services, J.P. Morgan Chase & Co. and other lenders are using different tactics to boost their fee income.

Some are raising minimum payments on certain customers’ accounts in order to increase late penalties. Others are ramping up credit-protection insurance programs and charging customers for coverage without permission. Still others are pushing aggressively into high-fee prepaid cards, which are exempt from most of the new rules. Get the full story »

Nov. 5, 2010 at 5:47 p.m.

Filed under:

Banking,

Credit Cards

By Becky Yerak

Chase plans to stop issuing new debit rewards cards in February. An executive from the bank disclosed the plans Thursday at a banking event.

A Chase spokesman said Friday that the bank is still reviewing the program for existing debit reward customers. Get the full story »

Nov. 2, 2010 at 10:05 a.m.

Filed under:

Credit Cards,

Earnings,

International,

Travel

By Associated Press

MasterCard Inc. on Tuesday said increased use of credit and debit cards overseas helped lift its third-quarter profit by 15 percent.

Oct. 27, 2010 at 3:53 p.m.

Filed under:

Credit Cards,

Education

By Becky Yerak

Credit card issuers paid $83 million to colleges, alumni groups, fraternities and sororities in 2009, and the University of Illinois Alumni Association received the biggest payment, according to a new Federal Reserve report.

The U.S. credit card act passed in 2009 requires credit card companies to submit to the Fed annually a copy of any agreement between the issuer and the college and alumni group, including how much they pay for the right to market their cards. Get the full story »