Nov. 11, 2010 at 10:09 a.m.

Filed under:

Policy,

Politics,

Transportation

By Associated Press

Gov. Pat Quinn says a Wisconsin trainmaker is welcome to move its jobs to Illinois.

Quinn is inviting Talgo Inc. to come to the state after Wisconsin’s newly elected Republican governor said he wanted to give back federal money for a proposed high-speed rail project or use it for something else.

Nov. 10, 2010 at 3:29 p.m.

Filed under:

Consumer news,

Policy,

Politics

By Dow Jones Newswires

White House adviser Elizabeth Warren said her meetings with investors and bank executives are going well, helping to give the financial industry a better sense of the new Consumer Financial Protection Bureau’s direction and priorities.

“I have really been on the road,” Warren told CNBC, noting that she’s been traveling the country meeting with community bankers, consumer advocates, chief executives of the largest financial firms and buy-side investors. Warren said she has discussed the agency’s approach to regulation and outlined its likely first steps “to make it really clear where we’re headed.” Get the full story »

Nov. 10, 2010 at 2:57 p.m.

Filed under:

Mortgages,

Policy,

Politics

By Associated Press

The Federal Reserve says it will buy a total of $105 billion worth of government bonds starting later this week as it launches a new program to invigorate the economy. Get the full story »

Nov. 9, 2010 at 3:06 p.m.

Filed under:

Policy,

Politics

From Bloomberg | Illinois is planning $1.5 billion in tobacco-bond sales as soon as Nov. 30 to pay bills and balance its budget. The bonds, to be backed by payments from a 1998 settlement with tobacco companies, will be sold the week after Thanksgiving.

Nov. 9, 2010 at 2:46 p.m.

Filed under:

Policy,

Politics,

Transportation,

Updated

By Associated Press

Wisconsin governor-elect Scott Walker speaks to reporters Nov. 3, 2010. (AP Photo/Scott Bauer)

High-speed rail projects in Wisconsin and Ohio appear close to derailment, with Wisconsin’s outgoing governor saying Monday he’ll leave the future of his state’s project to his Republican successor, who has vowed to kill it, and Ohio’s incoming governor saying again he plans scrap his state’s project.

Jim Doyle, Wisconsin’s outgoing Democratic governor, told The Associated Press that although he thinks a high-speed rail line to connect Milwaukee with Madison is a good idea, he feels obligated to leave the project’s future up to Republican Gov.-elect Scott Walker.

Minutes after Doyle made his comments, Walker said he remains opposed to the $810 million project. Get the full story »

Nov. 8, 2010 at 3:31 p.m.

Filed under:

Policy,

Politics

By Associated Press

Fed governor Kevin Warsh, right, with Fed Chairman Ben Bernanke on Aug. 27, 2010. Warsh expressed doubts on Monday about the Fed's $600 billion bond-buying plan. (AP Photo/Reed Saxon)

A Federal Reserve official with a close working relationship with Chairman Ben Bernanke is expressing skepticism over the Fed’s new $600 billion program to bolster the economy.

Kevin Warsh, a Fed governor, warns that there are “significant risks” associated with the Fed’s bond-buying program, including the potential for triggering inflation.

The Fed’s program, announced last week, is aimed getting Americans to spend more and invigorate the economy by making loans cheaper. But Warsh doubts the program will have “significant” or “durable benefits” for the economy. Despite his reservations, Warsh voted for the program. Get the full story »

By Reuters

The American Medical Association unleashed its latest salvo Monday in its campaign against cuts in Medicare payments to doctors with a survey that finds overwhelming concern among Americans.

The physician’s group did an online survey of 1,000 Americans aged 18 and older and found 94 percent of them said they are concerned about the cuts to doctors who treat elderly patients.

The group released the findings at a meeting in San Diego to kick off a new advertising and lobbying push to convince lawmakers to block payment cuts — set to take effect Dec. 1 — before they recess for the Thanksgiving holiday later this month. Get the full story »

Nov. 8, 2010 at 1:42 p.m.

Filed under:

Banking,

Economy,

Government,

Politics

By Dow Jones Newswires

Former Alaska Gov. Sarah Palin is deeply concerned about the Federal Reserve’s plan to buy $600 billion worth of U.S. bonds to boost the economy, placing the former vice presidential candidate in line with Germany in questioning U.S. monetary policy.

Palin is expected to demand that Federal Reserve Chairman Ben Bernanke “cease and desist” the stimulus injection, according to National Review Online, which said it obtained snippets of Palin’s prepared remarks scheduled for Monday before a trade association in Phoenix. Get the full story »

Nov. 8, 2010 at 10:21 a.m.

Filed under:

Investing,

Policy,

Politics

By Reuters

Wall Street’s lead lobbying group said on Monday it wants to help shape the “Volcker rule” on risky bank trading, among many other provisions, as the biggest financial reforms since the 1930s are implemented. Get the full story »

Nov. 5, 2010 at 5:36 p.m.

Filed under:

Economy,

Policy,

Politics

By Reuters

Government-controlled mortgage buyer Fannie Mae is asking for $2.5 billion in additional federal aid after posting a narrower loss in the third quarter.

Fannie Mae also said Friday it was likely that the market disarray and suspension of foreclosures due to big lenders’ problems with flawed documents will have a negative impact on the delinquency rates of its loans, its expenses and foreclosure timelines. However, the company said, “we cannot yet predict the extent of its impact.” Get the full story »

Nov. 5, 2010 at 4:06 p.m.

Filed under:

Policy,

Politics

From The Bond Buyer | The city of Chicago is postponing next week’s $804 million bond sale, hoping to secure better interest rates. Chicago’s credit ranking has been cut by Fitch Ratings twice in less than three months. “We are trying to minimize the perceived Illinois penalty by showing investors that the city’s exposure to state payment delays is limited and that we don’t have the same risk as some other borrowers because of Chicago’s home-rule status,” said city chief financial officer Gene Saffold. “The state collects our share of income taxes and sales taxes but it is pretty well caught up.”

Nov. 5, 2010 at 2:49 p.m.

Filed under:

Media,

Politics,

TV,

Updated

By Associated Press

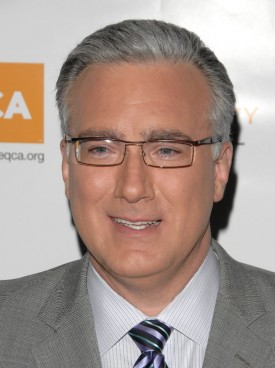

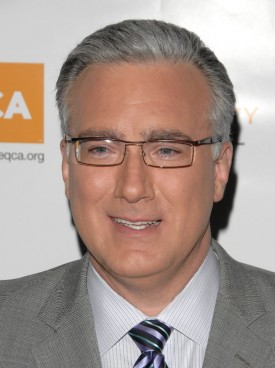

Keith Olbermann. (AP Photo/Peter Kramer, file)

MSNBC has suspended prime-time host Keith Olbermann indefinitely without pay for contributing to the campaigns of three Democratic candidates this election season.

Olbermann acknowledged to NBC that he donated $2,400 apiece to the campaigns of Kentucky Senate candidate Jack Conway and Arizona Reps. Raul Grivalva and Gabrielle Giffords.

NBC News prohibits its employees from working on, or donating to, political campaigns unless a special exception is granted by the news division president — effectively a ban. Olbermann’s bosses did not find out about the donations until after they were made. The website Politico first reported the donations. Get the full story »

Nov. 3, 2010 at 10:17 a.m.

Filed under:

Earnings,

Housing,

Policy,

Politics,

Real estate

By Associated Press

Government-controlled mortgage buyer Freddie Mac on Wednesday posted a narrower loss of $4.1 billon in the third quarter as it asked for an additional $100 million in federal aid — substantially less than the $1.8 billion it sought in the second quarter.

Nov. 2, 2010 at 5:32 p.m.

Filed under:

Food,

Policy,

Politics

By Tribune newspapers

San Francisco’s board of supervisors has voted, by a veto-proof margin, to ban most of McDonald’s Happy Meals as they are now served in the restaurants.

The measure will make San Francisco the first major city in the country to forbid restaurants from offering a free toy with meals that contain more than set levels of calories, sugar and fat. Get the full story »

Nov. 2, 2010 at 11:08 a.m.

Filed under:

Economy,

Policy,

Politics

By Reuters

The U.S. Federal Reserve opens a two-day meeting on Tuesday that is expected to conclude with a decision to pump hundreds of billions of dollars into the economy to stir the tepid recovery out of its doldrums. Get the full story »